Open Interest Indicator in Swing Trading

24/01/23

Open Interest in Swing Trading: Significant Insights for Traders

Swing Trading Blog by TradeNeon

The Significance of the Open Interest Indicator in Trading

In the world of the financial market, there are numerous indicators that assist traders in making informed decisions. One of these indicators that we want to delve into today is the Open Interest Indicator. It may seem simple at first glance, but its analysis can provide us with valuable insights into market movements.

Table of Content

Open Interest in Swing Trading:

What does the Open Interest tell you?

What does the Open Interest tell you?

Basics of the Open Interest Indicator

Basics of the Open Interest Indicator

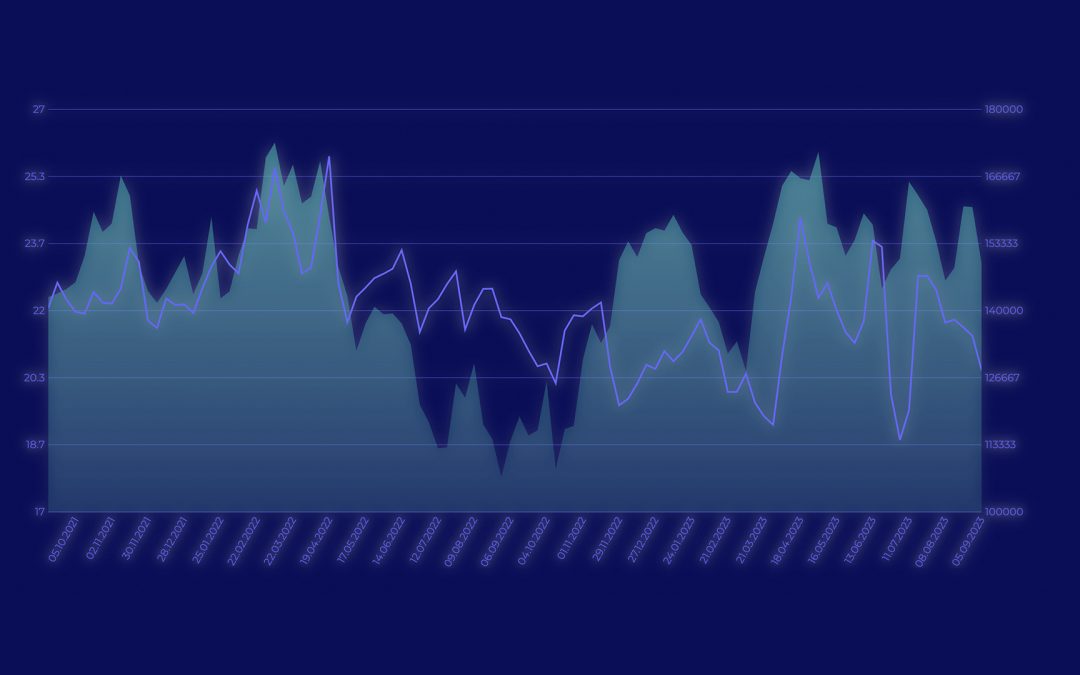

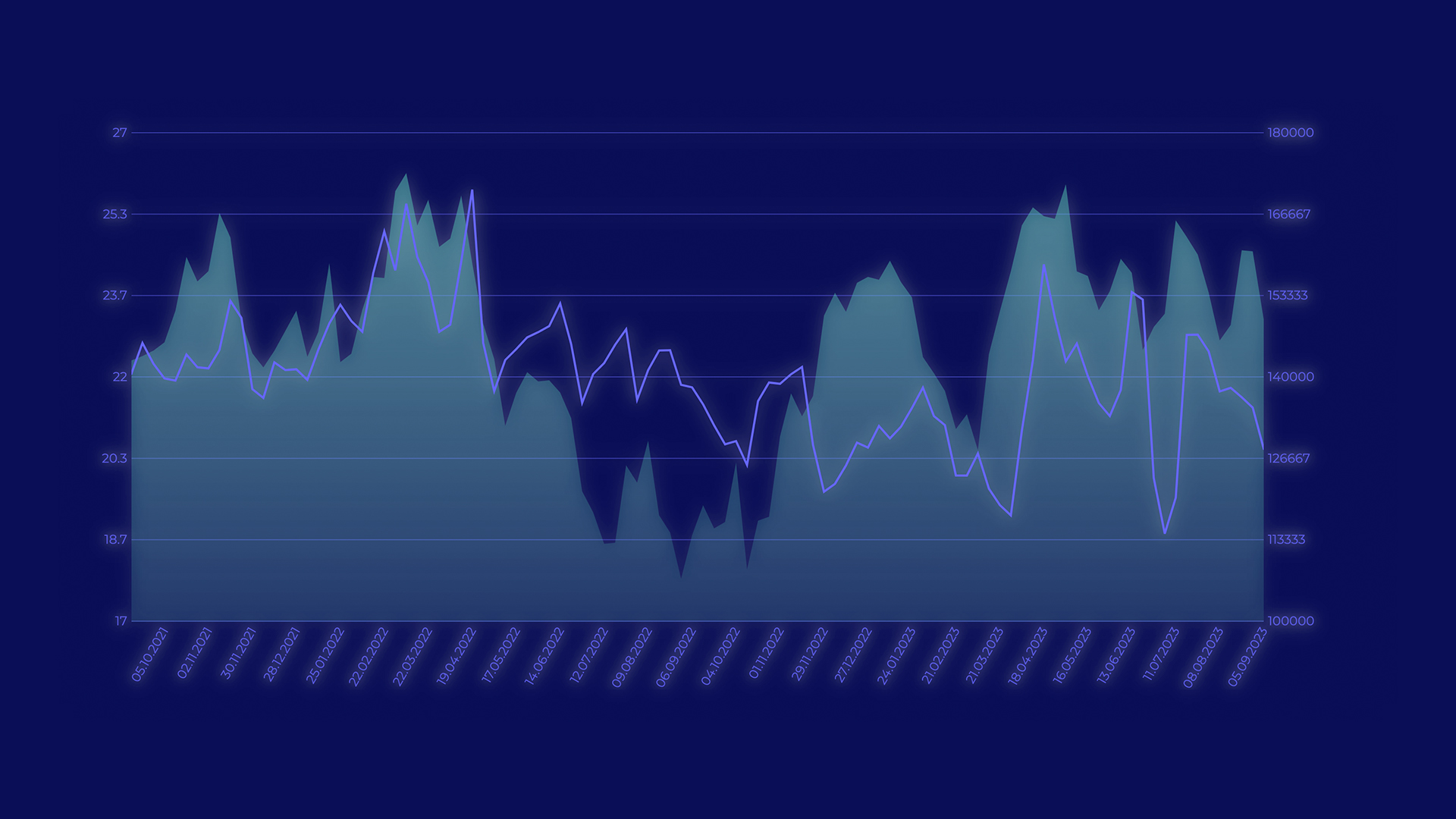

The Open Interest Indicator consists of two line charts. The foreground graph represents the historical development of open interest on a weekly closing price basis. In contrast, in the background, you can see the price movement of the respective market. Through open interest, we can gain some very interesting insights into the market: Are positions being built or liquidated? Is a trend strong or weak? Is the interest in the market or commodity currently high or low?

Open Interest

Indicates the strength of a trend and the interest of market participants in it

Kursverlauf

The price movement indicates the market's price development

Trend Analysis with Open Interest

Trend Analysis with Open Interest

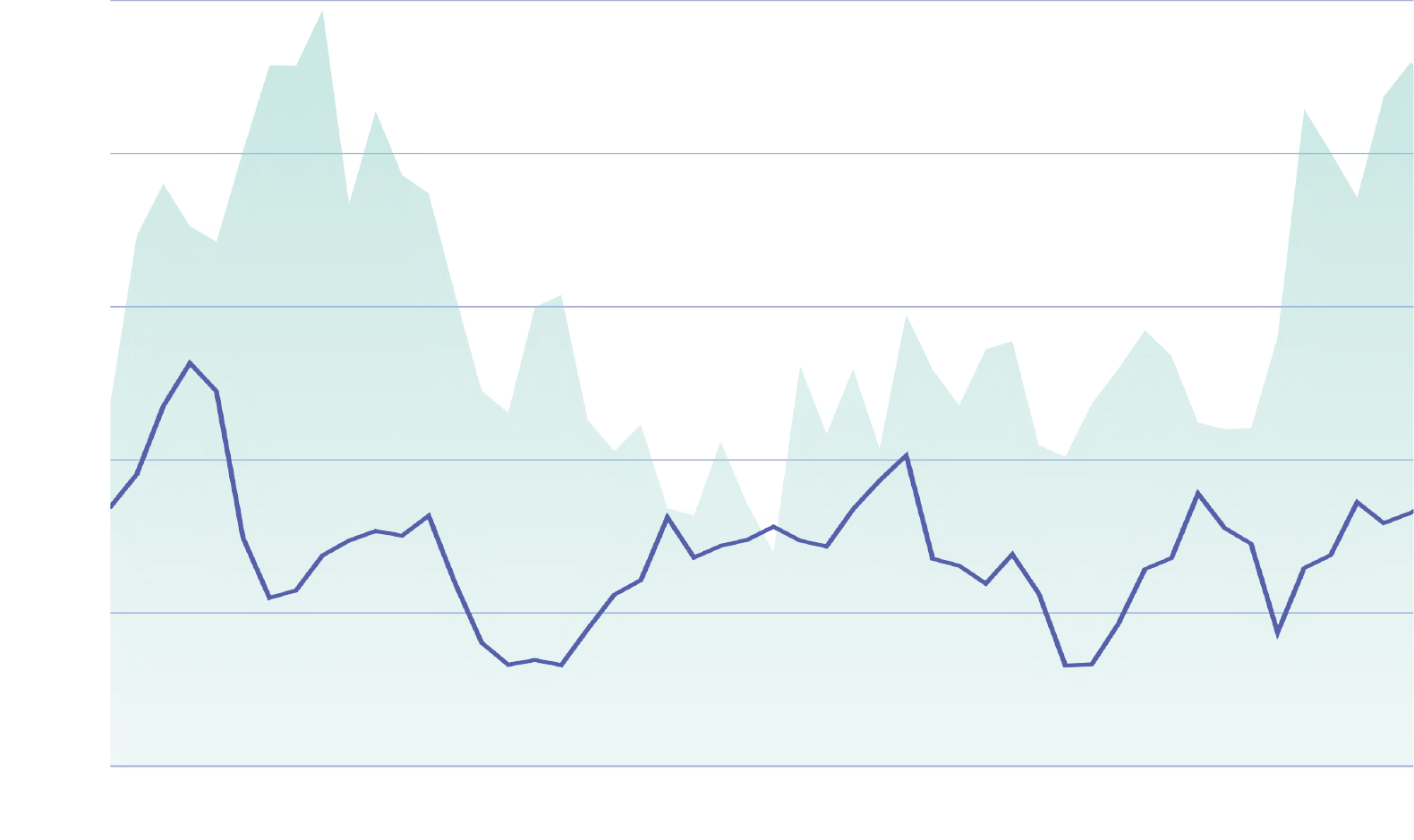

In a clear uptrend or downtrend where open interest is increasing, it indicates that new trades are being executed. This confirmation of interest suggests that the trend is likely to persist. However, it becomes interesting in cases of divergences – if open interest decreases while the trend continues, it may suggest an impending reversal or at least a correction.

Open interest is increasing in the trend

Whether Long or Short: The interest in the trend is high; the trend is intact.

Open Interest is decreasing in the trend

Whether Long or Short: Interest in the trend is decreasing, a trend reversal is possible.

Bei einigen Märkten Open Interest kongruent zu Kursverlauf

Bilden sich in diesen Märkten Divergenzen zum Kurs, sind Kurskorrekturen oder Reversals möglich

Market-Dependent Interpretation

Market-Dependent Interpretation

It is important to note that the indicator should be interpreted differently depending on the commodity. For example, in the gold market, there is a clear correlation between open interest and price. In other markets, such as corn, specific trends and deviations can be observed.

Practical Application Using the Example of Corn and Silver

Practical Application Using the Example of Corn and Silver

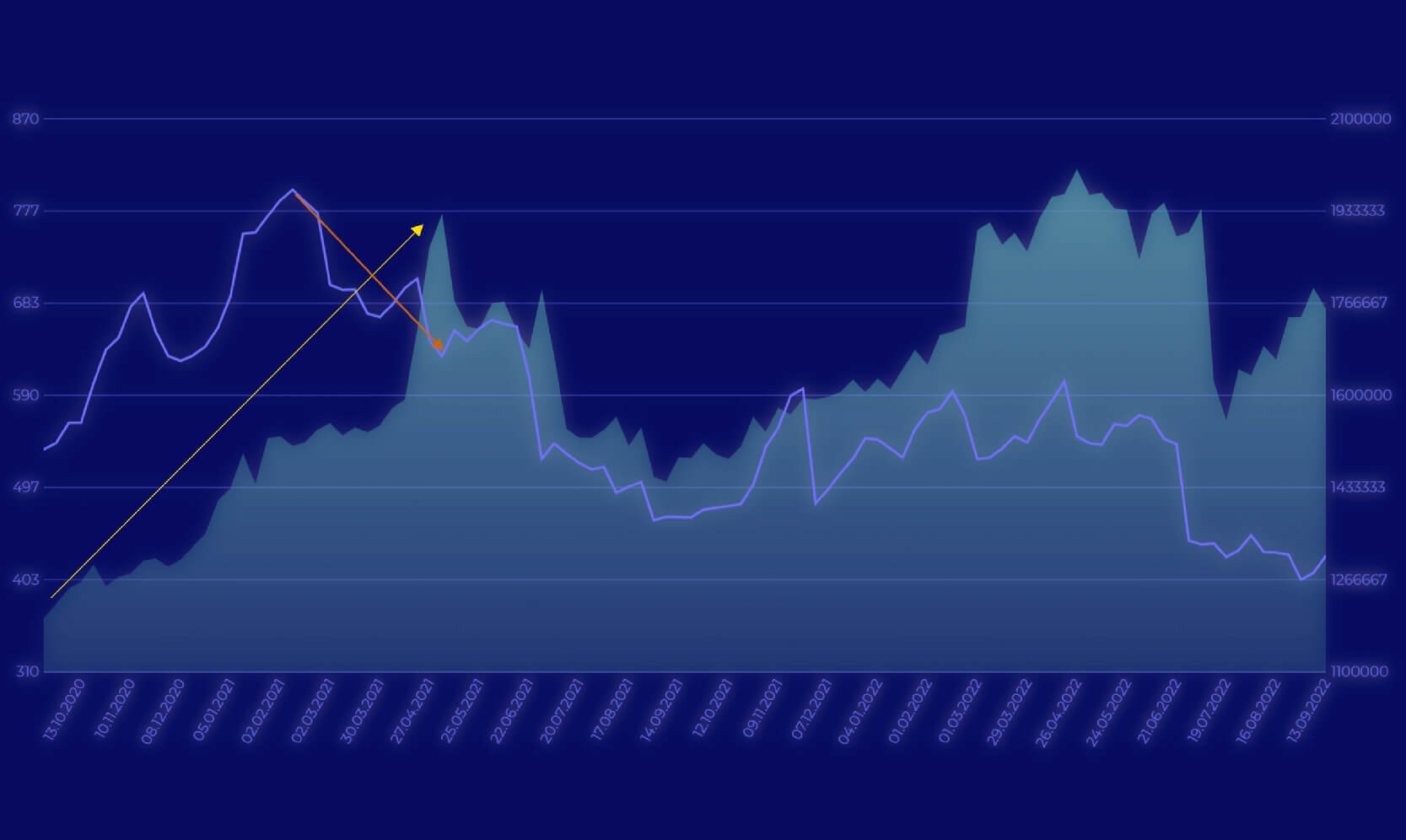

From February 2021, the open interest noticeably began to decline. Based on a shortage of supply, there was another significant increase in prices before the trend clearly reversed downward. Also, in the summer of 2022, we could see how the open interest anticipated the price movement. It initially dropped, and a few weeks later, the price followed suit.

Warning Signs with Low Open Interest

Warning Signs with Low Open Interest

Conclusion: Taking a Look at Open Interest is Worthwhile

Conclusion: Taking a Look at Open Interest is Worthwhile

During periods of low open interest, the market may become more volatile, and conventional analyses may be less reliable. Therefore, it is advisable to always keep an eye on the open interest indicator. It serves as a valuable tool for traders to gain a better understanding of market dynamics and to base their trading decisions on solid ground.

Shout it out

SHARE ARTICLE NOW

That's TradeNeon

Boost Your Trades

3 tools: automated analysis of the CoT report, identification of seasonal patterns, and monitoring the development of futures term structures. These are presented through 7 unique sentiment indicators covering 25 of the most important futures markets – all easily accessible on one dashboard.

Tutorials

TradeNeon

Discover all TradeNeon tutorials on all 7 sentiment indicators now to unleash the full potential of the software! Take your trading skills to a new level!

YouTube market analysis

YouTube Channel

We analyze futures markets using CoT data, seasonal patterns, and term structures. Learn from practical examples how to identify high-quality trading opportunities for options and futures trading.

Boost your Trades

TradeNeon

TradeNeon comes with 2 subscription models: Subscribe to the monthly plan and cancel anytime. Or choose the annual plan and save 33%! Start your 2 weeks free trial now!

What does the Open Interest tell you?

What does the Open Interest tell you? Basics of the Open Interest Indicator

Basics of the Open Interest Indicator Trend Analysis with Open Interest

Trend Analysis with Open Interest Market-Dependent Interpretation

Market-Dependent Interpretation Practical Application Using the Example of Corn and Silver

Practical Application Using the Example of Corn and Silver

Warning Signs with Low Open Interest

Warning Signs with Low Open Interest Conclusion: Taking a Look at Open Interest is Worthwhile

Conclusion: Taking a Look at Open Interest is Worthwhile